On January 23, 2024, the Malta Financial Services Authority (‘MFSA’) published a circular to Company Service Providers authorized in Malta (‘CSPs’), delineating several changes designed to streamline regulatory submissions for 2024 onwards.

One of the main changes relates to information previously included in the certificate of compliance, which is now part of the updated Annual Compliance Return (‘ACR’), eliminating the need for a separate Certificate of Compliance.

The Main Changes:

- The removal of the submission of Certificate of Compliance

- All CSPs are no longer required to submit the Certificate of Compliance in the form previously set out in Annex 2 of the CSP Rulebook. This information is now included in the ACR.

- The removal to submit Annual Financial Return for individual CSPs

- The information which would have been included in the Annual Financial Return, is now required to be included in the ACR.

- The submission of the Statement of Solvency by ‘individual’ CSPs, balance sheet and the Annual Financial Return is no longer required

- Irrespective of the class, individual CSPs, are no longer required to submit (1) a Statement of Solvency in the form previously set out in Annex 1 of the CSP Rulebook, (2) the accompanying balance sheet, not (3) the Annual Financial Return. The information previously required to be submitted separately, is now being incorporated in the ACR.

- The removal of Annual Self Declaration for all Under Threshold CSPs

- The confirmation that Under Threshold CSPs still fall within the applicable thresholds to qualify for their classification, will now be included in the ACR.

- Changes to the submission of Financial Information by CPS constituted as Partnerships

- In the case of CSP established as a partnership, the audited financial, auditor’s management letter and auditors’ report are no longer required.

- Instead, a partnership shall submit:

- Annual income statement;

- Annual balance sheet; and

- Comprehensive note to the income statement and a balance sheet.

The mentioned documentation shall now be, signed by a minimum of two partners and submitted to the MFSA within 4 months following the financial year end.

-

- A CSP established as a civil partnership having a warrant or equivalent to act under threshold Class A CSP are no longer required to submit Audited Financial Statements since such information shall now be included in the ACR.

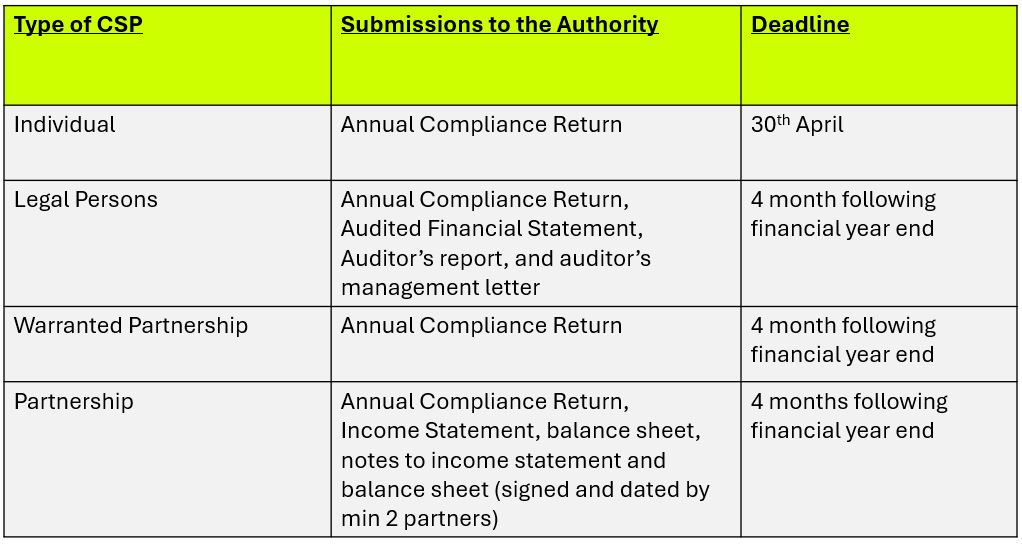

Timing of Submissions

Legal Persons CSPs are reminded that the ACR and other required information/documentation are required to be submitted (in both excel and in pdf format), 4 months following financial year end.

Individual CSPs are reminded that the ACR is required to be submitted (in both excel and in pdf format), by 30th April.

Notifications and Prior Approvals to the MSFA

Surrender of CSP License

A new requirement is introduced wherein CSPs established as a legal person need to inform the Authority on its decision on whether to liquidate and wind up the company, upon surrendering voluntary the CSP license.

In the event that the CSP does not wish to formally enter into liquidation proceedings, it shall present a draft of its Constitutional Document whereby all references to it being a CSP are removed including any reference of CSP in the name of the CSP.

This changes promotes the idea of not confusing or misleading the public about the services offered by a legal body.

Evidence of the submission of the updated Constitutional Documents are necessary to be provided within two weeks of the publication of the notice.

Change in address of CSPs

The CSP shall notify the MFSA in writing about cases where a Class A CSP (i.e. those providing formation of companies or other legal entities; and, or provision of a registered office, a business correspondence or administrative address and other related services for a company, a partnership or any other legal entity) and Class C CSP (i.e. those providing all of the services of a company service provider) who intend to use a different address from the provision of such services to client through an address which is not the official registered address of CSP.

Appointment of an Approved Person

A CSP cannot proceed with appointing an Approved Person without the prior consent of the MFSA being received by the said CSP.

Other Changes

Frequency of the Compliance Checks of CSPs:

The CSP shall regulatory monitor the adequacy and effectiveness of its systems, internal control mechanisms and arrangements annually instead of six months.

Other notifications

All CSPs are required to notify the MFSA immediately in the below scenarios:

- It is notified that its auditor intends to qualify audit reports;

- It becomes aware of actual intended legal proceedings against it;

- It decided to claim on a professional indemnity or other policy relating to its CSP business.

Breaches

The updates rules clarify that any breaches of the Act, the Regulations issued thereunder or the CSP Rulebook, should be reported in the appropriate field in the ACR.

Removal of requirement to notify the Authority if ACR will be submitted after due date

Previously, a CSP was required to notify the Authority if it became aware that it would be unable to submit an Annual Return on the due date. In view of the Authority’s position explained in the MFSA’s Policy Document on Non- Material Enforcement Action (as may be amended from time to time) this Rule has been removed.

Stay up to date

Recent News & Insights

Stay up to date with the world of business and tax with news, insights and articles from our expert editors, accountants, and advisors. Our professionals provide valuable perspective on a range of topics that can help inform your business decisions and keep you informed about industry trends.

Upcoming 30th April Deadlines

Micro Invest 2025

IFRS 18

ISA for LCE

Deadlines – April 2024